7 Questions to Ask When Buying a House: A Financial Planner’s Perspective

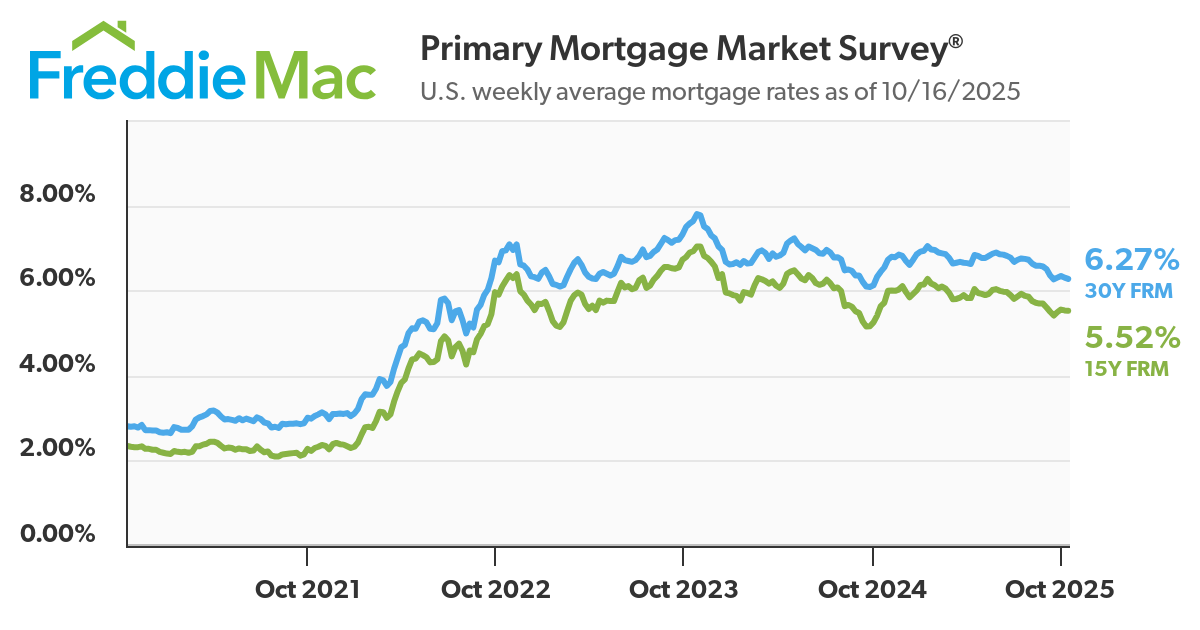

Since the last housing blog that I wrote (Buying a House on a Shoestring Budget), the homebuying environment has changed dramatically. According to Freddie Mac, the average interest rate on a 30-year mortgage has gone from 2.81% in October 2020 to 6.27% at the time of this writing.

Freddie Mac graph of 15- and 30-year mortgage interest rates from October 2020 through October 2025.

That combined with the current housing market completely changes the way that most people should approach looking at a home purchase. There are seven key questions I believe you should ask when buying a house today:

How much house can I afford?

How important is it to avoid personal mortgage insurance (PMI)?

Is renting a waste of money?

How much should I put down?

30-year mortgage, 15-year mortgage, or pay in cash?

Is it okay to buy without an inspection?

Who do I need around me to make the experience successful?

Let’s explore these along with a CERTIFIED FINANCIAL PLANNER™ professional’s perspective on how to answer them.

1. How much house can I afford?

The first thing you need to think about is the principal and interest payment. This is the “PI” portion of the “PITI” that you might sometimes see talked about when people are discussing monthly mortgage payments. There are a lot of good mortgage payment calculators out there, so find one from a reputable source. Personally, I like this one from Bankrate because it also allows you to put in numbers for insurance, PMI, and taxes.

To that point: you’ll also need to think about how the taxes, homeowner’s insurance, and personal mortgage insurance (PMI) is going to impact your cost of ownership.

In a lot of the United States, property tax isn’t much of a factor. Here in Rochester and in a good portion of New York State, property taxes are incredibly high.

For example, I just pulled up Zillow and found a house in Pittsford, NY with an asking price of $300,000. Assuming a 20% down payment (to avoid personal mortgage insurance) and a 30-year mortgage at 6.27%, the monthly payment is $1,480. Perfectly reasonable.

Well, when you navigate to the Monroe County Real Property Portal to look up the property taxes, you learn that the Town/County tax and the School Tax adds $8,500 per year of cost. That means your $1,480/mo payment turns into a $2,188/mo payment. That can really make or break someone’s budget.

So how do you even decide if you can afford a particular payment? There are a lot of ways to do it, but my recommendation is to add up what you actually spent over the past 12 months (not your “budget”), compare it to how much you brought home, and see how much more room there is over the course of the year between what you brought in and what you spent (this, of course, assumes that you’re already saving adequately). From there, it’s up to you to decide how much more expense you can take on and still achieve your goals. If you need help with that, it’s one of the many things I cover with my clients.

2. How important is it to avoid personal mortgage insurance (PMI)?

I personally don’t think it’s overly important to avoid PMI. The cost of PMI is paid on a monthly basis, doesn’t depend on the interest rate of the mortgage, and will fall off once you’ve reached 80% equity in your home.

In my professional opinion, it’s much more important to have plenty of cash when you’re going into owning a house. If you can afford to put 20% down, still have an adequate emergency fund, cover additional closing costs, and breathe comfortably then great! But, if you can’t, it’s perfectly alright to have to pay PMI. Just factor it into your monthly budget.

3. Is renting a waste of money?

Here’s a hot take: in some areas (including here in Rochester, NY), renting is often not a waste of money when compared to owning a house. The key here is if you’d otherwise be owning in an area with high property tax.

Remember the example of the $300,000 house I used above? The monthly taxes alone on that house alone are right around $700 per month. According to Zillow Rentals, the average rent in the Rochester area (the metropolitan area that Pittsford, NY is located in for anyone reading who isn’t from around here), is $1,453 but there are over 100 properties listed for rent below $800 per month.

With the housing market the way it is, the argument isn’t so much “I could own a house for what rent costs,” but it’s more “I could pay my taxes with what rent costs, and then I’d have to pay for the house on top of it”.

Of course, there are areas with much more affordable houses that have lower taxes. And I don’t want you to think I’m advocating for people to never buy a house. But, if it’s not your goal to buy a house or you’re on the fence about it, don’t let people tell you it’s a terrible idea to keep renting. You’re doing a good job!

4. How much should I put down?

This sort of goes back to the PMI question, but there’s no one-size-fits-all answer (and don’t let anyone tell you there is)! I would say put down as much as you comfortably can without stretching yourself. With interest rates as high as they are, the opportunity cost of having money tied up in your home is lower than it was when interest rates were low. But always stick to the fundamentals of financial health: depending on your situation, you should have between three to twelve months’ worth of expenses in a completely liquid high-yield savings account as your emergency fund. Don’t let your aspiration of putting more money down compromise this piece of your financial foundation.

With that said, there are some really interesting mortgage programs out there that require a certain percentage of the purchase price down. One of the lenders I recommend offers a cash guarantee program so that their buyers can compete with all-cash buyers. If a buyer uses a lender that has a cash guarantee and the buyer’s financing falls through, the lender guarantees that they will purchase the property. In the eyes of the seller, this is basically as good as a cash offer. Let the minimum requirement of your loan program be your starting point and go from there.

5. 30-year mortgage, 15-year mortgage, or pay in cash?

When interest rates were in the 2.8% range, I was telling almost everyone to go with a 30-year mortgage and put as little down as possible because it was super cheap money, provided a ton of flexibility, and freed up people’s cash to do other things.

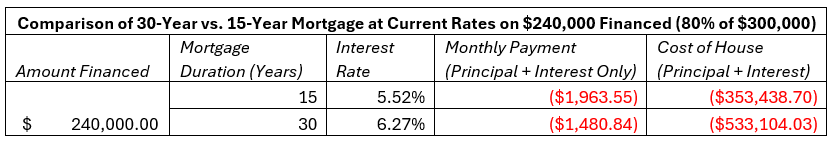

Now, it’s less straightforward. As the table below shows, the 15-year mortgage has a significantly higher monthly payment but saves the buyer about $180,000 versus the 30-year mortgage. The flip side of that is if the buyer hits financial challenges, the extra almost $500 per month minimum payment required on the 15-year mortgage versus the 30-year provides significantly less flexibility.

Table showing the monthly payment and total amount of principal and interest paid on a 15-year vs 30-year mortgage.

There are situations where paying for a house in cash makes sense, where a 15-year mortgage makes sense, and where a 30-year makes sense. This is way too nuanced of a situation for me to give you any sort of guidelines other than to say if you have a partner with plenty of income and/or an abundant emergency fund, a 15-year mortgage could make sense. Otherwise, there’s absolutely nothing wrong with going for the 30-year mortgage! Paying cash for a house is another beast completely, and I wouldn’t even feel comfortable giving a rough guideline for when it would make sense. I would need to see the perfect conditions in a client’s situation for me to recommend it.

6. Is it okay to buy without an inspection?

Umm, I wouldn’t? I don’t know, maybe I’m a coward. But every time I’ve heard of a house horror story, I asked if the buyer had to waive the inspection and they did. My realtor friends and clients will be yelling at me saying that in this environment it’s almost impossible to win a bid with an inspection required. I totally get that. That’s just a pretty strong risk for a buyer. And, without an inspector involved, there’s no one advising the buyer who doesn’t have a financial interest in the transaction going through.

But, if you do have to buy without an inspection, get an inspection done as soon as possible once you own the house and go into the purchase with an extra-healthy emergency fund.

7. Who do I need around me to make the experience successful?

Financial Planner

I personally believe that the home-buying process starts with understanding exactly how much house you can afford. If you don’t have a firm grasp on that, working with a qualified financial planner can help with that.

Real Estate Agent

The next partner you need is an awesome realtor who vibes with your personality. Being a realtor is an incredibly demanding job, but there are a ton of realtors who consistently go above and beyond to provide their clients with an excellent experience. I have recommendations for both selling and buying agents if you need some!

Loan Officer

It’s often the case that the realtor will have a strong relationship with a loan officer. They can provide pre-approvals and help you understand the process of applying for the mortgage. Just keep in mind: shopping around for the best rate is important. Make sure, though, that not too many lenders are running your credit as it may damage your credit score.

Real Estate Attorney

You don’t understand how important it is to have a good real estate attorney until you have a bad one. They are making sure that the transaction is clean and that you won’t run into any issues down the road. If you’re trying to save a bit of money at closing, some attorneys are able to represent both the bank and you at the same time if you sign a waiver of conflict.

Wow, this was a lot longer than I had originally intended it to be! But I think it’s important to talk about these essential questions to ask when buying a house so that you can understand the current environment and how to be successful in it! Of course, I’m happy to walk you through any of this in detail and even point you in the direction of some excellent real estate experts who can help. Reach out when you have a minute!

John Howe-Wemett, CFP®, AEP®, MSFP